JBL Live 660NC vs Tune 660NC - $99 vs $199 - Bluetooth Noise Cancelling Headphone Comparison Review - YouTube

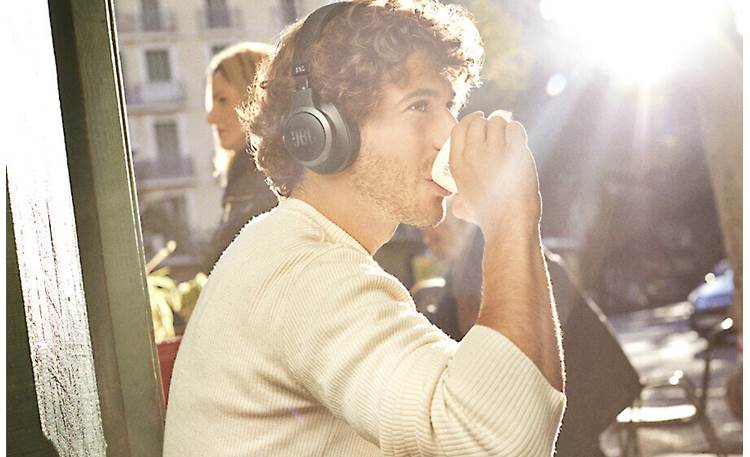

Amazon.com: JBL Live 660NC - Wireless Over-Ear Noise Cancelling Headphones with Long Lasting Battery and Voice Assistant - Black : Electronics

Amazon.com: JBL Live 660NC - Wireless Over-Ear Noise Cancelling Headphones with Long Lasting Battery and Voice Assistant - White : Electronics

Amazon.com: JBL Live 660NC - Wireless Over-Ear Noise Cancelling Headphones with Long Lasting Battery and Voice Assistant - White : Electronics